Goldman Sachs Invests in Simetrik's Automation Technology for CFOs

Close to two years after raising $20 million in Series A funding, B2B financial solutions startup Simetrik has secured an additional $55 million in Series B funding.

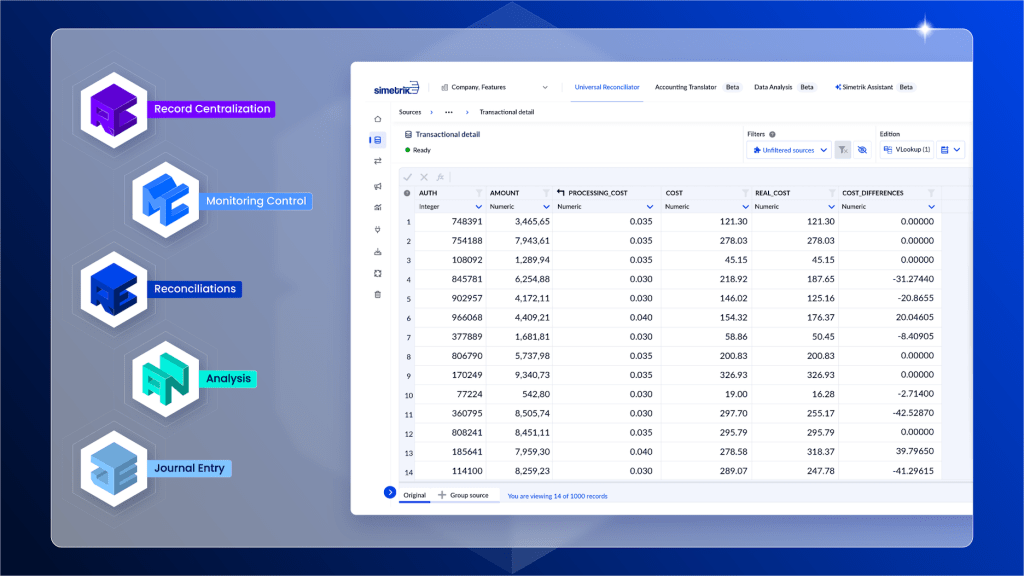

The Colombia-based company is focused on developing financial automation technology that revolves around record centralization, reconciliations, controls, reporting, and accounting. What sets it apart is its Simetrik Building Blocks (SBBs), which are scalable and adaptable concepts based on no-code development and generative AI technologies.

Goldman Sachs Asset Management led the investment round, with participation from Series A lead FinTech Collective, seed investor Cometa, Falabella Ventures, Endeavor Catalyst, Actyus, Moore Strategic Ventures, Mercado Libre Fund, and the co-founders of Vtex.

This new funding brings Simetrik's total venture-backed investment to over $85 million. The company has expanded its client base to more than 35 countries and is currently monitoring over 200 million records daily, up from 70 million records prior to the Series A. Revenue has also quadrupled since the initial funding round.

In addition to serving high-growth Latin American entities like Rappi, Mercado Libre, Nubank, Oxxo, and PayU, Simetrik has partnerships with PagSeguro, Falabella, Itaú, and firms like Deloitte. The company has also expanded its presence in Asia, including India and Singapore.

The new funds will be used to further develop the Simetrik Building Blocks, enhance AI capabilities, and expand Simetrik's international presence. Co-founder and CEO Alejandro Casas highlighted the increasing demand for innovative fintech products and services, especially as organizations are dealing with larger volumes of records and reports but still rely on manual processes. Simetrik's building blocks aim to address this market need.